AI + HITL Intake for Insurance Tracking

Allied Solutions LLC

Allied AI Document Intake Summary

TL;DR — AI-Powered Document Intake (Human-in-the-Loop)

- Role: Service Design Lead / Product Design

- Org: Allied Solutions

- Scope: End-to-end intake pipeline (ingest → classify → extract → validate → index), HITL exception handling, ops workflow UI, auditability, compliance

- Partners: Operations, Data Science/ML, Platform Engineering, Compliance/Legal, QA

Outcomes

- 90% reduction in manual touch per document (HITL thresholds + straight-through processing)

- Same/next-day indexing vs. multi-day backlog (cycle-time compression)

- 1M+ / month documents handled with audited trail and exception queues

- Rolled out across multiple regions with standardized operating procedures and dashboards

How we measured

- Manual effort: % of documents requiring human intervention and average handling minutes per doc, pre/post launch (sampled by doc type).

- Cycle time: Timestamp delta from ingestion to indexed/available; SLA attainment (same-day / next-day) by region.

- Quality: Classification/extraction accuracy via stratified QA sampling; precision/recall on key entities.

- HITL safety: Confidence-threshold tuning and rework rate; exception queue aging and resolution time.

- Compliance & audit: Verified audit logs (who/what/when); periodic controls reviews with Compliance/Legal.

Reconstructed summary for portfolio; no client data or internal screenshots shown.

Project Overview

Allied Solutions tracks insurance coverage for lenders and processes related cancellations/refunds. Paper intake had exploded across carriers and channels (mail, fax, email scans), pushing operations into recurring backlogs and compliance risk. My remit: redesign the service, evaluate document-AI options, and stand up a reliable pipeline with human oversight.

Timeline — H2 2023

Partners — Ops, Compliance, Engineering, Client Success, external IDP vendors

Initial Challenges

Scale & variability — >20 doc types (proof of insurance, endorsements, cancellations, notices), inconsistent layouts.

Backlogs — Peak load occasionally required exec “all-hands” to clear.

Accuracy & audit — Field-level traceability needed for lenders and regulators.

Dupes & misroutes — Multi-channel intake created rework and notice errors.

Methodology

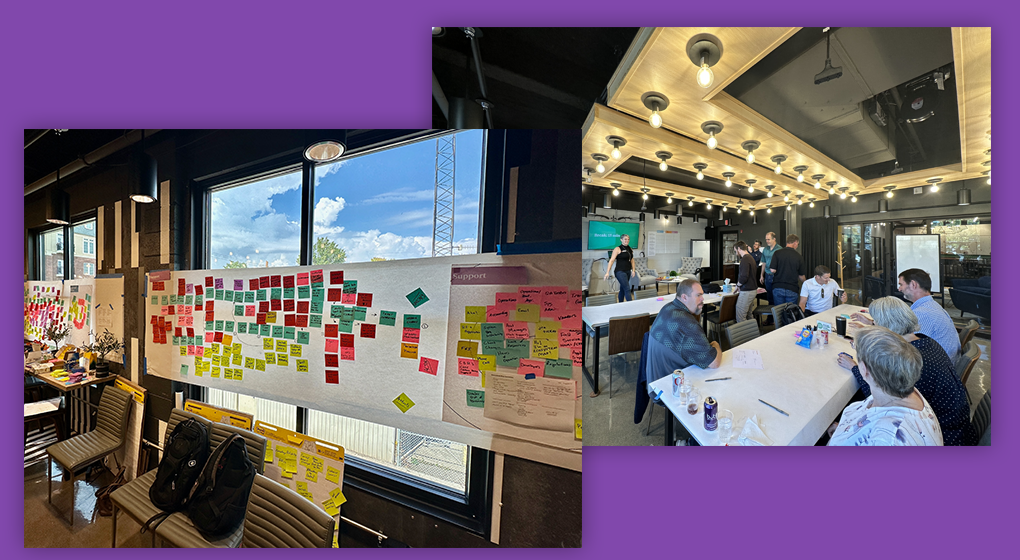

Discovery — Stakeholder interviews, mailroom shadowing, time/volume study, SOP/SLA review.

Mapping — Current-state service blueprint; pain-point clusters and high-risk handoffs.

Opportunity framing — Pareto on top doc types (~80% of volume); error taxonomy (VIN/policy mismatches, duplicates).

Vendor evaluation — Build-vs-buy, short-list IDP vendors, scoring on accuracy, latency, security/PII, auditability, integration, and TCO.

Pilot — Confidence thresholds, HITL queues, QC sampling, and a small ops dashboard for throughput/exception aging.

Solution at a Glance

Digitize & de-dupe — Batch scanning + email ingest with checksum/metadata de-duplication.

Classify & extract (AI/ML) — OCR/NLP with per-field confidence.

HITL exceptions — Below-threshold fields routed to specialists; 4-eyes QC on critical types.

Business rules & matching — Validate VIN/policy, match to loan, suppress borrower notices when valid coverage found.

Write-back & audit — API/file feeds to tracking systems with field-level provenance.

Governance & visibility — Throughput, exception aging, accuracy by type; model-drift checks and retraining cadence.

Outcomes

Throughput & staffing — Top-volume types moved to the pipeline; peak backlogs eliminated.

Cycle time — Same-/next-day indexing on priority docs (down from multi-day peaks).

Quality & CX — Fewer mismatches → fewer erroneous borrower notices; simpler audits.

Sustainable — SOPs, training, thresholds, and dashboard in place for ongoing ops.

Why This Matters

Insurance tracking/CPI programs depend on timely, accurate verification to protect lenders and avoid unnecessary borrower notices. Digitizing intake with AI + HITL scales throughput and preserves compliance.

My Contributions

Service blueprinting • Ecosystem mapping • Opportunity framing • Vendor RFP + scoring • Pilot design & metrics • HITL workflow + SOPs • Change mgmt & training • Governance & dashboard requirements

What I'd Do Next

Expand to long-tail doc types • Integrate carrier EDI where available • Add exception taxonomy for smarter retraining • Tie notice suppression more tightly to confidence bands